To start, let me give you an overview of Payment Service Providers and Fintech Companies.

Payment Service Providers (PSPs) are companies that provide merchants with the infrastructure and services necessary to process online payments. They act as intermediaries between the merchant, the customer, and the bank that processes the payment. Fintech Companies, on the other hand, are businesses that use technology to provide financial services. These can include mobile payment apps, budgeting tools, lending platforms, and more.

The explaination of an Intrusion Detection System

Both PSPs and Fintech Companies deal with sensitive financial information, making them a prime target for cybercriminals. As such, they need to employ a range of security measures to protect against unauthorized access, data breaches, and other forms of cybercrime.

One such security measure is Intrusion Detection Systems (IDS). IDSs are a type of software that monitors network traffic for signs of suspicious activity. They work by analyzing network packets and comparing them to known attack signatures or other patterns of malicious behavior.

When an IDS detects suspicious activity, it can trigger an alert or take other actions to mitigate the threat. This could include blocking traffic from a particular IP address or quarantining a device that is exhibiting unusual behavior.

Types of IDS systems

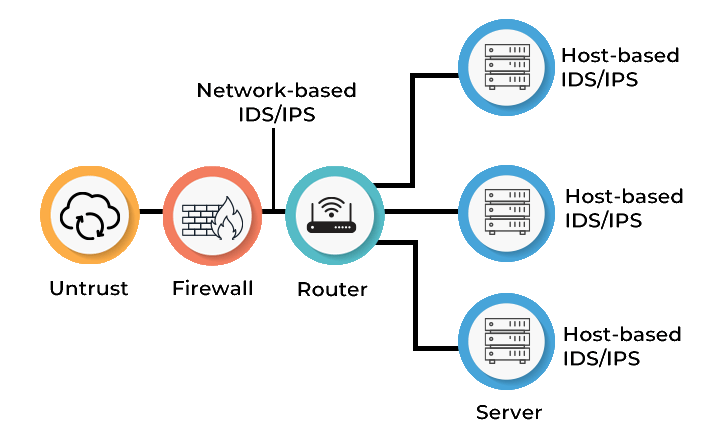

There are two main types of IDS: network-based IDS and host-based IDS. Network-based IDSs monitor traffic on the network as a whole, while host-based IDSs monitor activity on individual devices.

Network based

Network-based IDSs are typically deployed at key points in the network, such as the perimeter or between different segments. They can provide a comprehensive view of network traffic and help detect attacks that may span multiple devices or systems.

Host based

Host-based IDSs, on the other hand, are installed on individual devices, such as servers or workstations. They can provide a more detailed view of activity on a particular device and help detect attacks that may be targeted at a specific system.

In addition to these types, there are also hybrid IDSs that combine elements of both network-based and host-based IDSs. These can provide a more holistic view of network activity while still offering granular visibility into individual devices.

IDSs are just one of many security measures that PSPs and Fintech Companies can employ to protect their systems and data. Other measures may include firewalls, antivirus software, encryption, and access controls.

Conclusion

In conclusion, PSPs and Fintech Companies face unique security challenges due to the sensitive nature of the financial data they handle. Intrusion Detection Systems are a key security measure that can help detect and mitigate threats to their systems and data. By using a combination of different security measures, these companies can help protect against cybercrime and ensure the safety of their customers’ financial information.