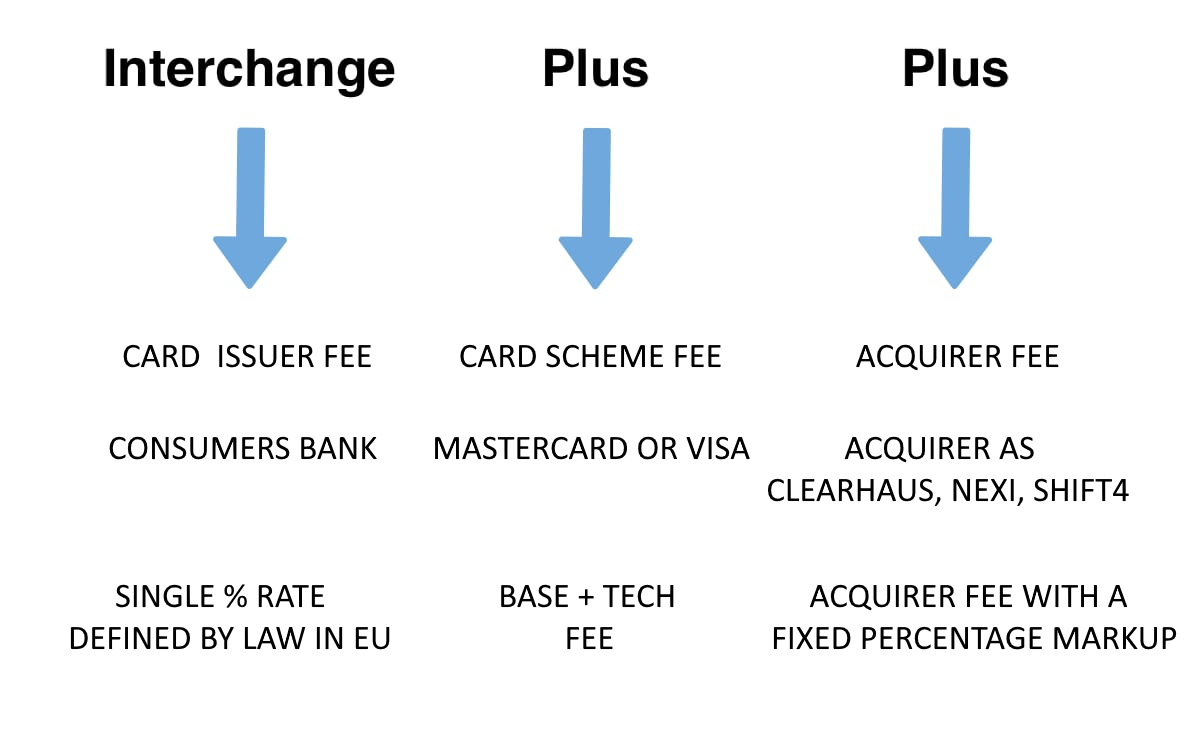

The IC++ pricing model is a pricing strategy used by some acquiring banks for processing credit and debit card transactions. IC++ stands for Interchange++.

The combination of costs with Interchange

An IC++ pricing model is a pricing structure used for card payments. It stands for “Interchange Cost Plus” and involves adding a markup to the cost of the interchange fee.

This markup is used to cover processing costs, manage risks, and generate revenue for the payment processor.

The payment industry often uses the IC++ pricing model, but the markup amount can vary based on the processor and type of card. Understanding the IC++ model and its included costs can help merchants make informed decisions when choosing an acquirer.

What is usually covered as processing costs

Processing costs refer to the fees that merchants pay to their payment processors for the ability to accept card payments from their customers.

These fees typically include:

- a transaction fee for each sale

- a monthly fee for maintaining the processing account

- a per-item fee for processing each transaction.

The exact amount of these fees can vary depending on the processor, the type of card being used, and the size of the transaction.

Some processors also charge additional fees for features such as chargeback protection or fraud prevention services.

The complexity of the Interchange pricing model

Some people find the IC++ pricing model for card payments challenging to understand due to its complex calculation that incorporates card network fees, interchange costs, and processing costs.

To make it more readable, it might be helpful to simplify the calculation and provide clear explanations of each component.

Are there any alternatives to IC++

Yes, there are alternatives to the IC++ pricing model for card payments.

These include Tiered Pricing, and Flat Rate Pricing.

The right model for your business depends on your specific needs and business model.

To choose the best option, consider the features and fees of each and talk to one of our payment processing experts.

Flat Rate Pricing in few words

With Flat Rate Pricing, card payment merchants enjoy simplicity and straightforwardness. They pay a single, flat fee for each transaction, consisting of a percentage of the transaction amount and a small per-transaction fee.

This pricing model is good for merchants who make a lot of small transactions. The flat fee stays the same no matter the transaction size. It’s also great for merchants who want clear and predictable payment processing costs.

This pricing model works best for merchants processing a large volume of low-value transactions, as the flat fee remains unchanged regardless of the transaction size. The predictability and ease of Flat Rate Pricing appeals to merchants seeking clarity in their payment processing costs.