Card scheme fees are the fees that credit card networks like Visa, Mastercard, American Express, and Discover charge for processing your credit card transactions.

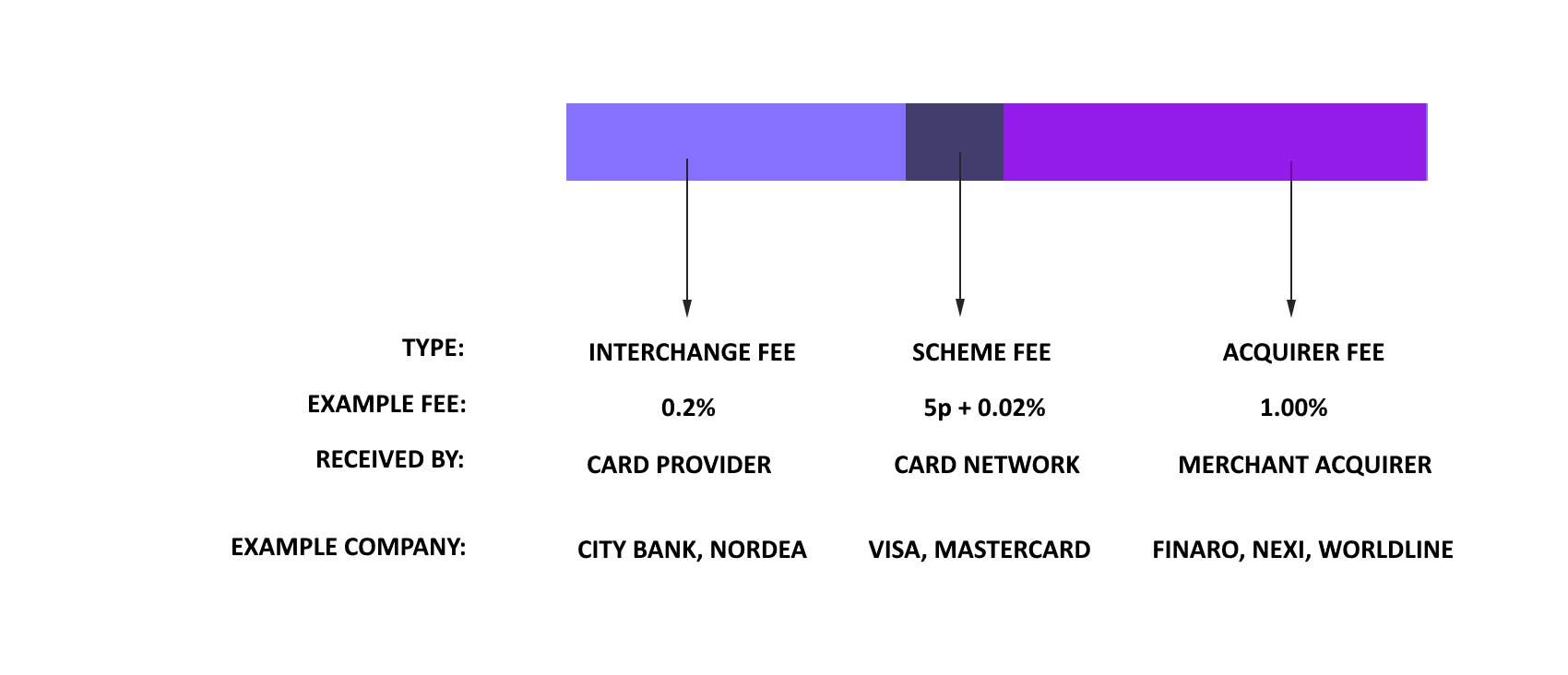

Who gets paid

When you make a purchase with your credit card, the fee for processing that transaction is paid by the bank that handles the transaction (called the acquiring bank) to the credit card network. This fee helps cover things like operating the network, fighting fraud, and other expenses. For merchants, these fees are one of the costs of doing business by accepting credit card payments.

Scheme fee decissions

The credit card networks like Visa, Mastercard, American Express, and Discover, decide the amount for processing fees. These fees are usually a combination of a percentage of the transaction value and a set fee. The fee amount can change over time and is usually reviewed and adjusted regularly to cover the costs of operating the network and keeping it secure.

These fees help cover the expenses of running the network and provide services to merchants and cardholders. As a merchant, these fees are a part of the cost of doing business by accepting credit card payments.

This is why you should be aware of the Scheme fees

Acquirers don’t all pay the same in Scheme Fees. The fee amount varies based on factors such as transaction size and volume, type of card accepted, and agreement with the credit card network.

Some acquirers negotiate lower fees due to high transaction volume, while others pay higher fees for extra services. It’s smart for merchants to compare fees from different acquirers and choose the best option for them.

The cheapest type of transactions in Scheme fees

Some transactions can cost less in terms of Scheme Fees. The amount of the fee depends on things like what type of card is used, how much the transaction is for, and the agreement between the business and the credit card network.

For instance, if you use a fancy credit card, the fees might be higher than if you use a basic card. And if you run a big business with a lot of transactions, you might be able to get a better deal on fees because you’re a big player in the game.